Camels Rating System Pdf

Camels rating system pdf. It is in this context that the CAMEL Rating System being utilized as a supervisory tool was revised to address changes in the banking services. The CAMELS rating system with Sensitivity to risks is a regulatory classification system that was adopted by the Federal Council in 1997. First the CAMELS rating system is intended to provide supervisors with a uniform and objective measure of banks risk3 that can be used to e ectively identify weak problem banks.

Among the major weaknesses of CAMELS system we should identify the subjectivity of assessment by experts of the bank insufficient quality of bank management that significantly influences the rating of components. FONACIER Deputy Governor __5__ March 2020 Att. National Credit Administration in October 1987.

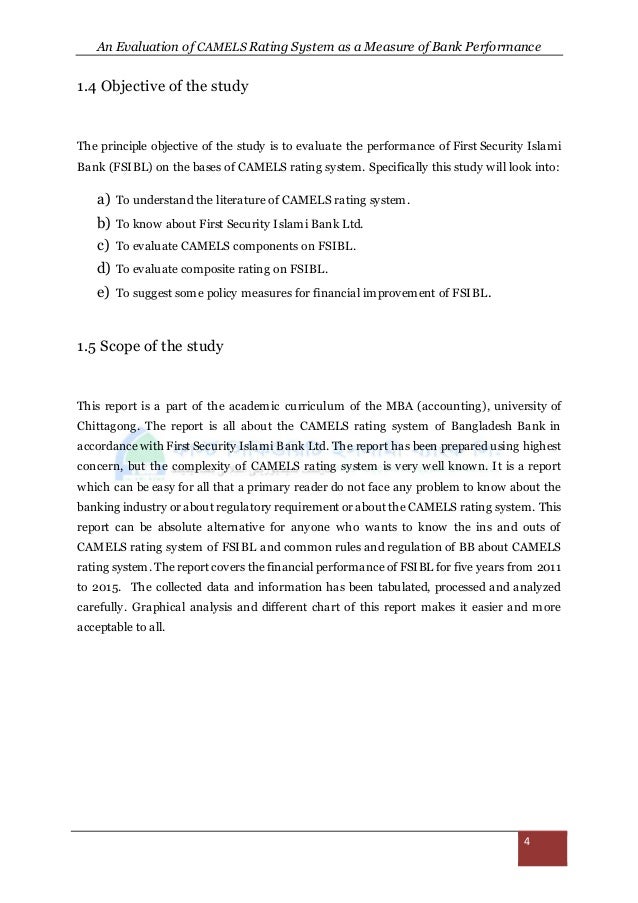

One of the most effective supervisory techniques CAMELS rating system basically a quantitative technique has been used to rank the banks based on their performances. The CAMEL rating is used as a private rating framework in bank analysis for its own investment purposes rather than that used by regulatory bodies in supervising the banks. 3 A rating of 3 indicates a less than satisfactory level of capital that does not fully support the institutions risk profile.

For information and guidance. According to Rose and Hudgins 2010 the CAMEL rating system is a plan developed by the federal banking regulators to assess the overall performance of commercial banks. CAMELS rating system.

A through D in ascending order. CAMELS RATING SYSTEM The supervisory processes of the Bangko Sentral over the banking system must continue to evolve and be responsive to the changing financial environment for such processes to be effective. Rating systems currently employed by the BSP including the CAMELS and ROCA rating systems effective 1 July 2020.

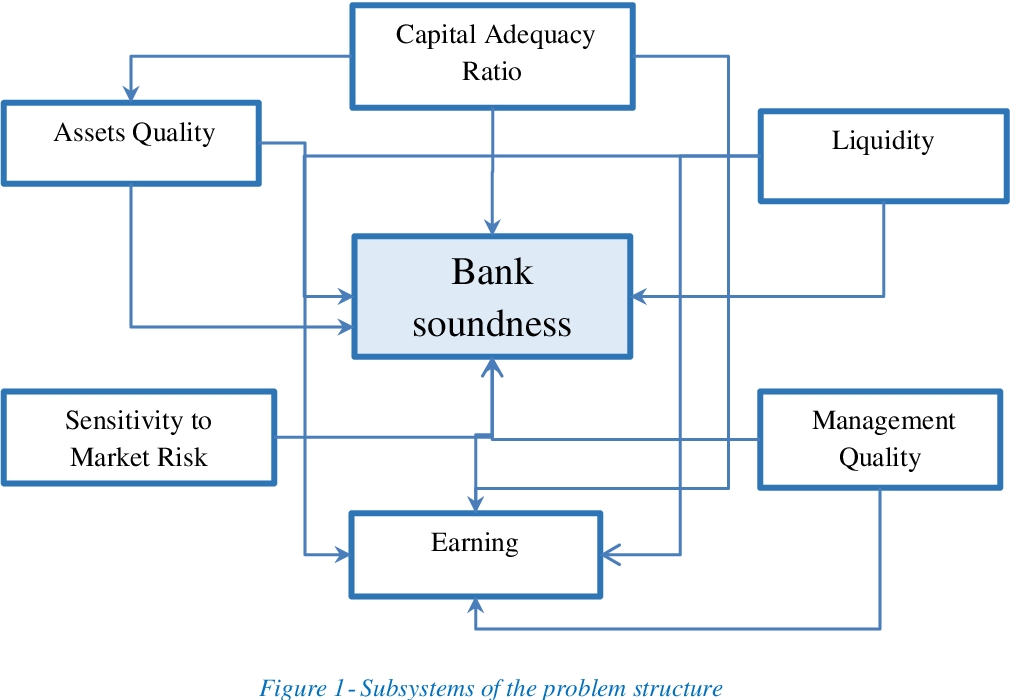

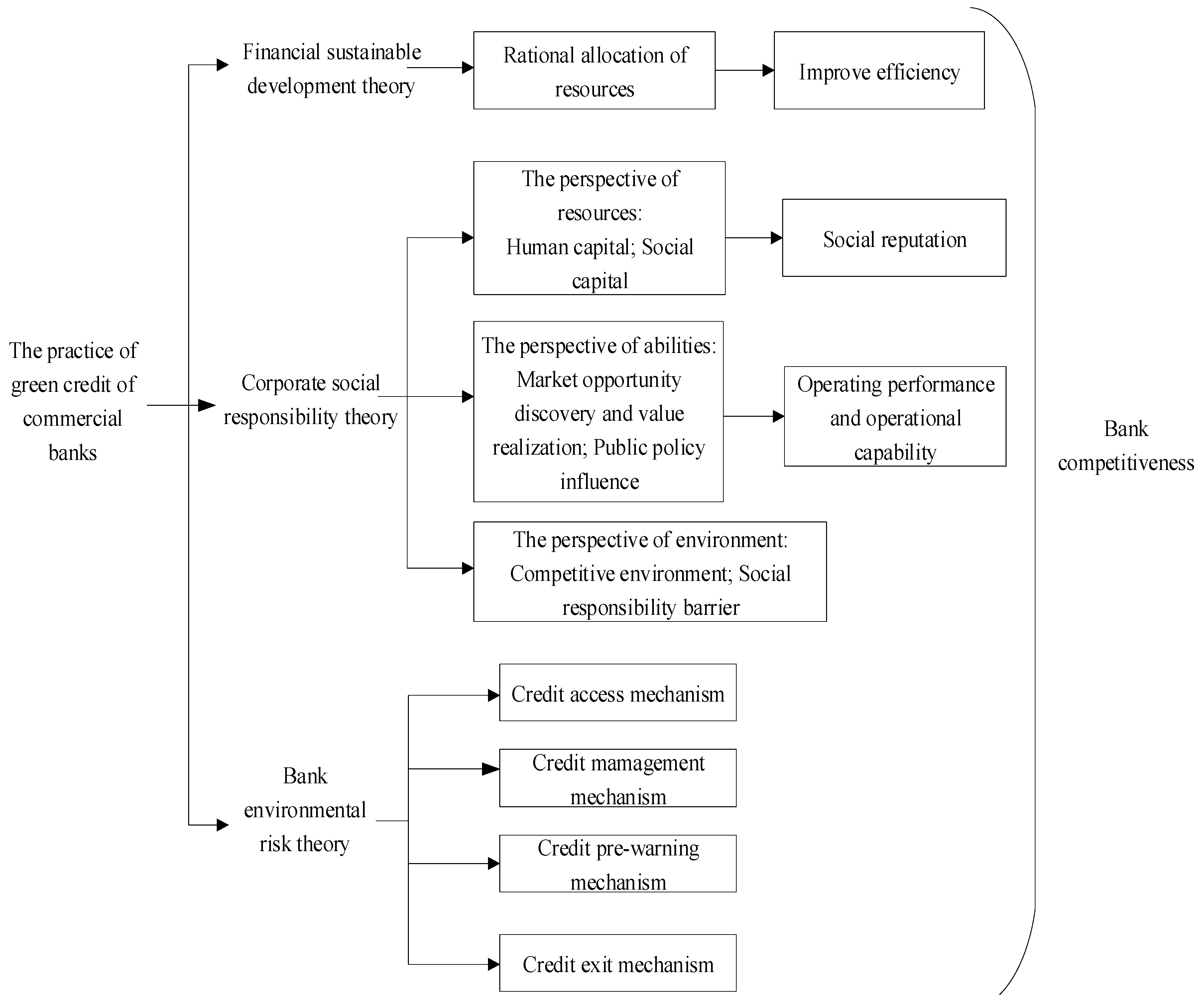

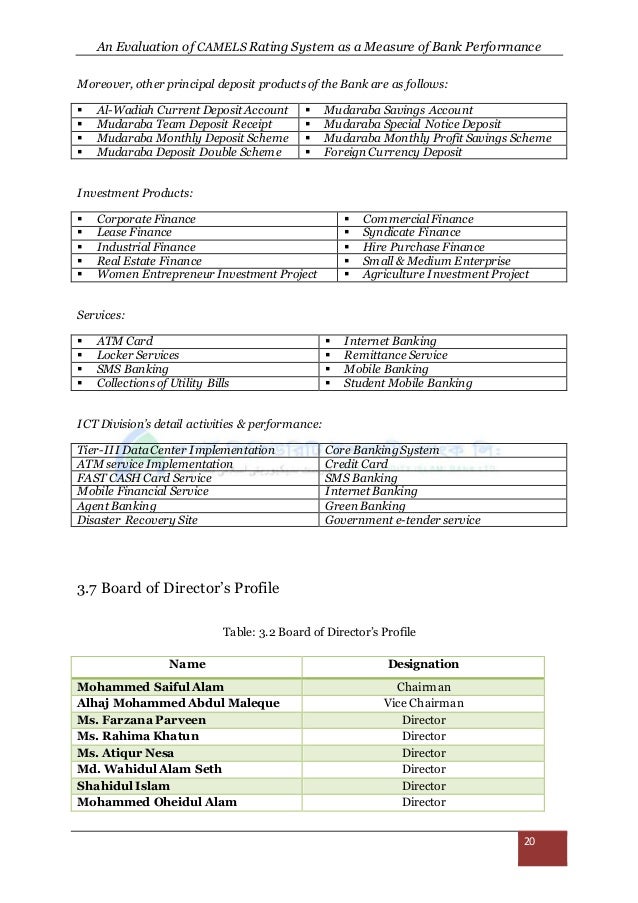

2 A rating of 2 indicates a satisfactory capital level relative to the credit unions risk profile. Comparative analysis shows that Eastern Bank has stood at the top position among all the selected banks based on CAMEL rating system. These components are Capital Assets Management Earning Liquidity and Sensitivity to market risk.

As OFFICE OF THE DEPUTY GOVERNOR FINANCIAL SUPERVISION SECTOR. And is also implemented outside the US.

The ratings are assigned based on a ratio analysis of the financial statements combined with on-site examinations made by a.

The CAMELS rating system with Sensitivity to risks is a regulatory classification system that was adopted by the Federal Council in 1997. These components are Capital Assets Management Earning Liquidity and Sensitivity to market risk. 146 A rating system for domestic and foreign banks based on the CAMELS model combining financial management systems and control elements has been in place since July 1998. According to Rose and Hudgins 2010 the CAMEL rating system is a plan developed by the federal banking regulators to assess the overall performance of commercial banks. It takes into account six important components of a bank when it evaluates performance of the bank. The CAMEL rating is used as a private rating framework in bank analysis for its own investment purposes rather than that used by regulatory bodies in supervising the banks. The present rating of banks is done on a 10-point scale ie. Comparative analysis shows that Eastern Bank has stood at the top position among all the selected banks based on CAMEL rating system. 2 A rating of 2 indicates a satisfactory capital level relative to the credit unions risk profile.

And is also implemented outside the US. The CELS ratings or CAMELS rating is a supervisory rating system originally developed in the US. The present rating of banks is done on a 10-point scale ie. The Board has determined that updating the NCUAs supervisory rating system from CAMEL to CAMELS by modifying the L Liquidity Risk component in the existing CAMEL rating system to include only liquidity evaluation content and rating criteria as outlined in the proposed rule along with the added evaluation factor examples is appropriate and consistent with the NCUAs overall mission to. At the end of the supervisory cycle supervisors assign CAMELS ratings to banks on a 1-to-5 scale where a rating of 1 is the highest. First the CAMELS rating system is intended to provide supervisors with a uniform and objective measure of banks risk3 that can be used to e ectively identify weak problem banks. Finally if the proposed Shariah benchmark is adopted by the regulators and supervisors that will undoubtedly enhance the supervisory strength and oversight and also establish strong confidence of the people in this new banking paradigm Introduction.

Post a Comment for "Camels Rating System Pdf"